Personalized &

Tax-Optimized Portfolios Made Simple

Unlimited customization and optimized tax management.

Super simple direct indexing.

Zero time spent by client-facing advisors reviewing rebalancing, and trading portfolios.

What We Do for Wealth Management Firms

Smartleaf makes managing personalized and tax-optimized portfolios simple and scalable. So simple and scalable that you can:

- provide every client of every size the highest levels of customization and tax management.

- work with direct indexes as easily as working with ETFs.

- free your advisors to spend zero (yes, zero) time rebalancing and trading portfolios.

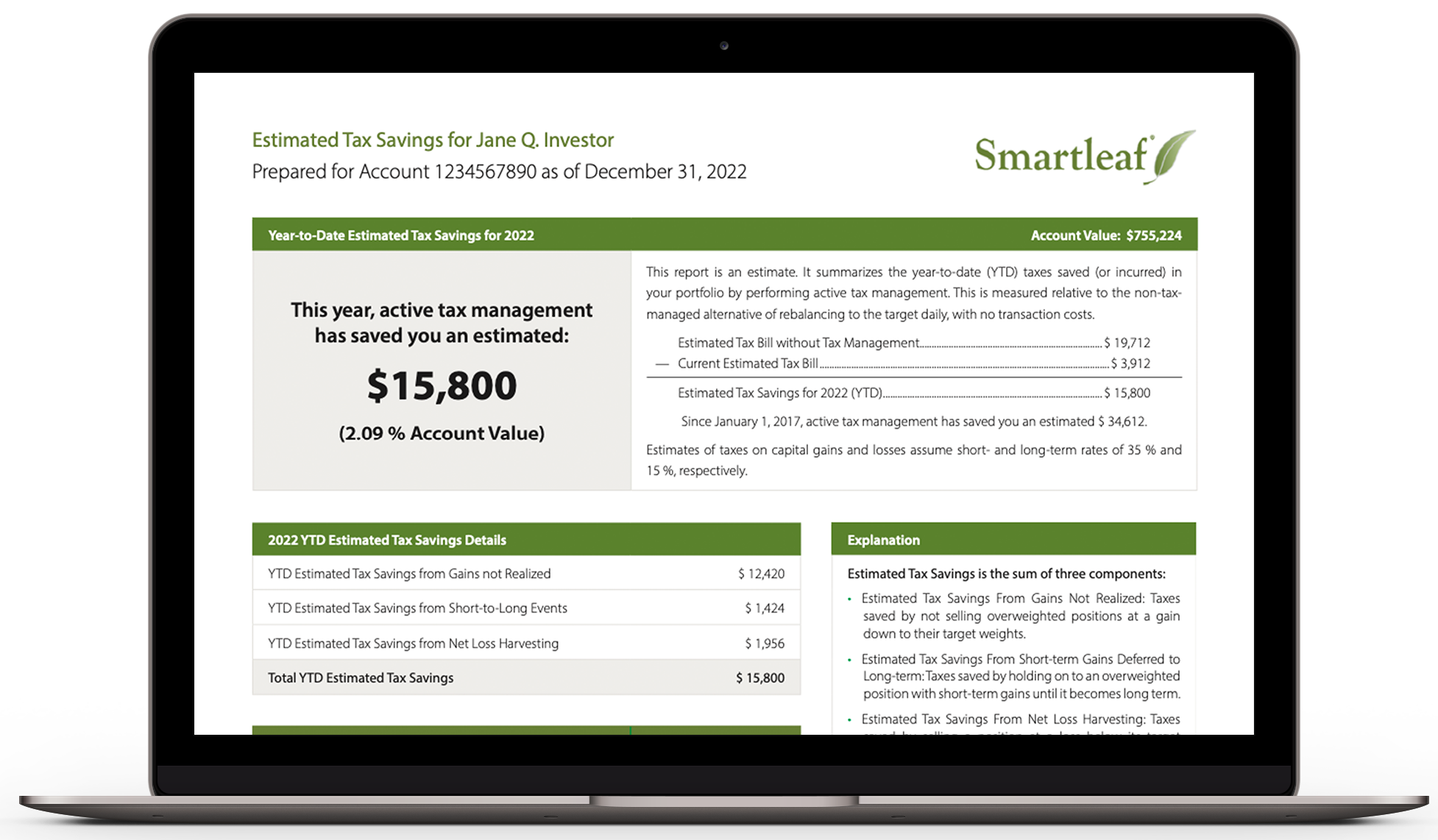

- document for each client their taxes saved or deferred, demonstrating your value.

Save your clients more in taxes than you charge in fees.

SAM

Smartleaf makes managing personalized portfolios easy. Smartleaf's RIA subsidiary, Smartleaf Asset Management (SAM), can make using the Smartleaf platform even easier by taking responsibility for portfolio review, rebalancing and trading, while leaving you in control of investment policy and the personalization parameters of each account.

Our Clients

Redefining the Meaning of Automation

We've ended up in a world where nearly every rebalancing tool calls itself “automated”, regardless of how automated it really ...

Start Reading

Year-Round vs. Year-End Loss Harvesting

If you're just getting around to tax loss harvesting, you're doing it wrong.

Start Reading

From our mailbox: how we address concerns about direct index lock up

A correspondent asks how we address concerns about direct indexes becoming “ossified”.

Start Reading