The Advisor Portal

Watch a short demo of how to onboard and customize a new account using Smartleaf's Advisor Portal. We'll replace an ETF with a direct index, add a tobacco screen, add a security constraint, configure custom cash management settings, and then set up a multi-year, tax-sensitive transition.

All in about six minutes.

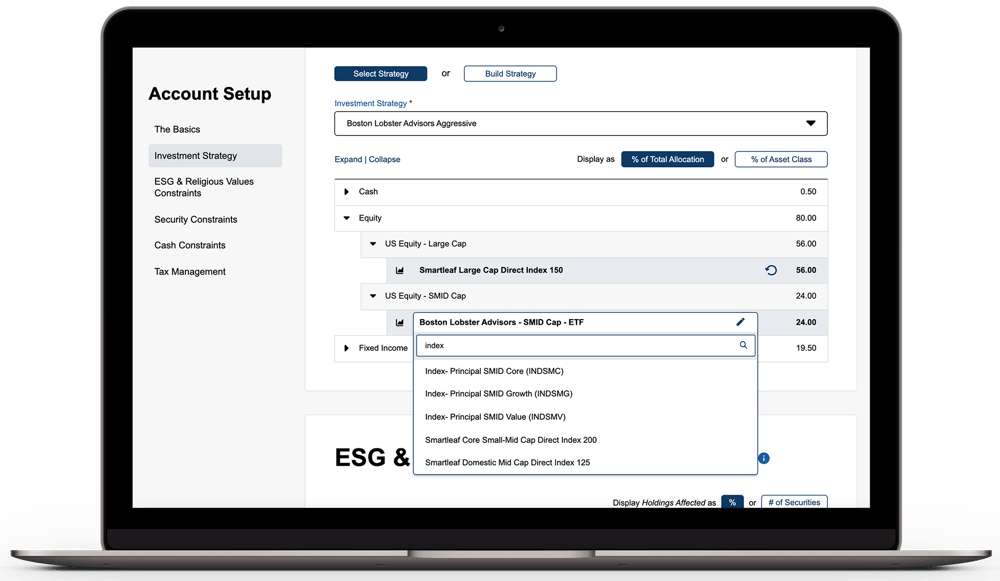

Investment Strategy

Follow your own asset allocation strategies or choose one that was created by 3rd party experts. Provide default investment vehicles while offering acceptable alternatives in every asset class. Replacing a model with a direct index requires no separate account setup, no extra signatures and no waiting.

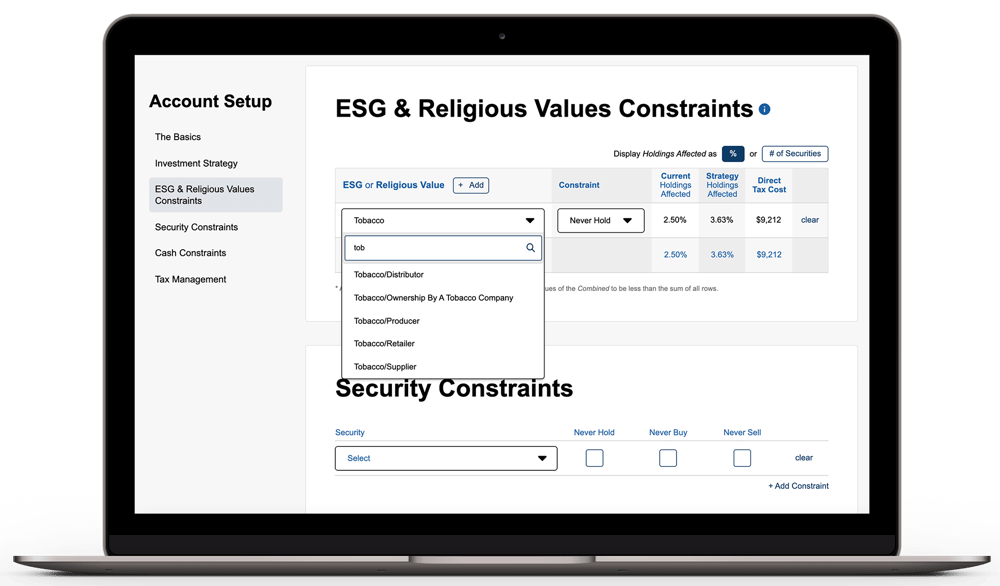

ESG & Religious Values

Select from a number of ESG and Religious values constraints provided by MSCI with real time feedback on how a screen influences the current holdings, the investment strategy and the tax implications of taking action.

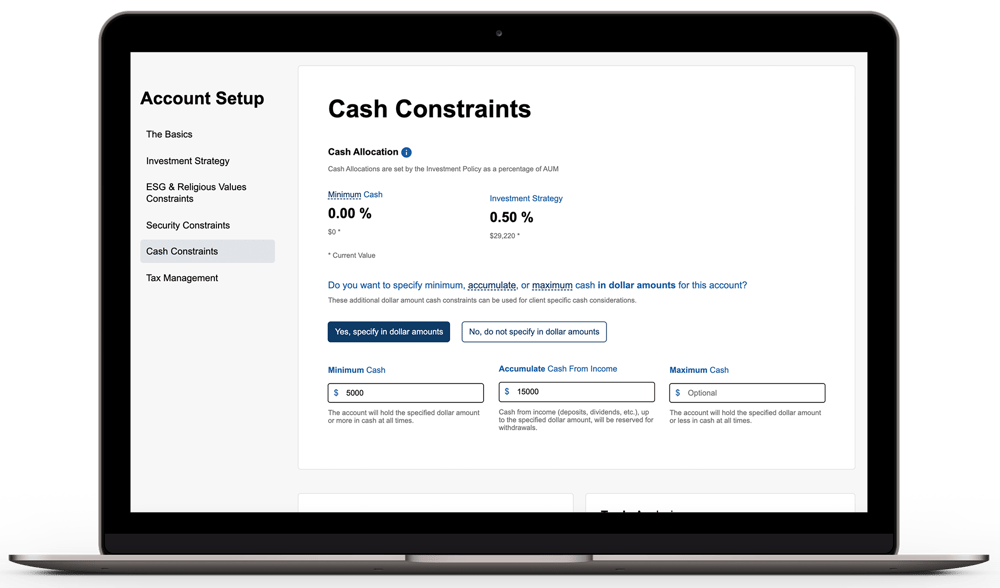

Cash Constraints

Specify the minimum cash amount for every client, with the ability to set aside all income from interest and dividends up to a certain amount, typically for withdrawals. Cash maintenance is automated.

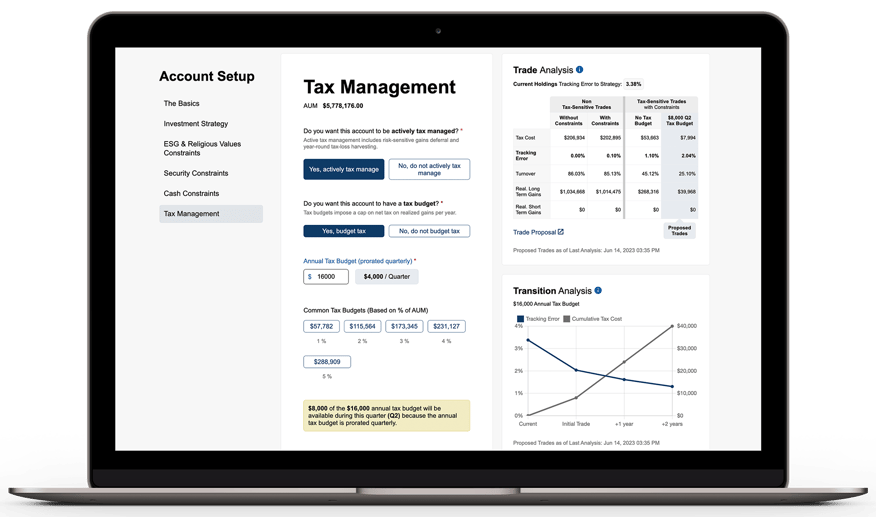

Tax Management

With active tax management, clients will get year round tax loss harvesting, short and long term risk adjusted gains deferral, optimized tax lot election, and wash sale avoidance. And if they want, a multi year tax sensitive transition plan.

With the Trade and Transition Analysis reports, Smartleaf compares the scenarios of ignoring all taxes and constraints, ignoring all taxes, following Smartleaf’s tax sensitive recommendations, and following Smartleaf’s tax sensitive recommendations while adhering to a tax budget. This gives real-time feedback to advisors and clients.

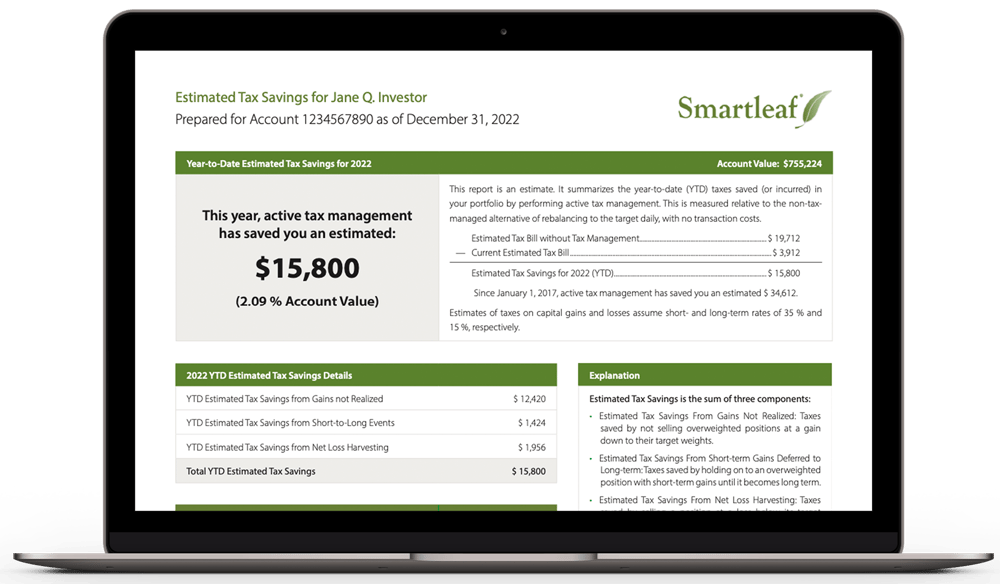

Taxes Saved Report

The Estimated Taxes Saved or Deferred Report (“ETSoDR”) is an estimate of how much in taxes you save or defer through active tax management for your client, comparing the taxes on realized capital gains of their portfolio relative to the hypothetical alternative where their account was traded exactly to their target model every day.

The report displays tax savings from gains not realized, short-to-long events and net loss harvesting. The report can be shared any day with clients. Last year, Smartleaf users saved or deferred their clients an average of 3.07% of portfolio value in taxes for assets that were actively tax-managed.

About The Advisor Portal

Smartleaf provides investor-facing advisors with a dedicated portal for setting up accounts, entering customization and tax management preferences, and notifying the trading group that the client wants to withdraw cash. As the advisor sets up the portfolio, the portal gives them and their clients real-time feedback on the tax and risk implications of their customization choices, helping clients make informed decisions. For example, if you add a social screen, the portal will tell you how much of the current portfolio would be liquidated and the tax consequences. And, for new accounts, the system will, in real time, show you proposed first trades and provide you with a projection of a multi-year tax-optimized transition plan.