Smartleaf is the premier automated overlay portfolio management solution for banks and RIAs. Below are some highlights from 2015.

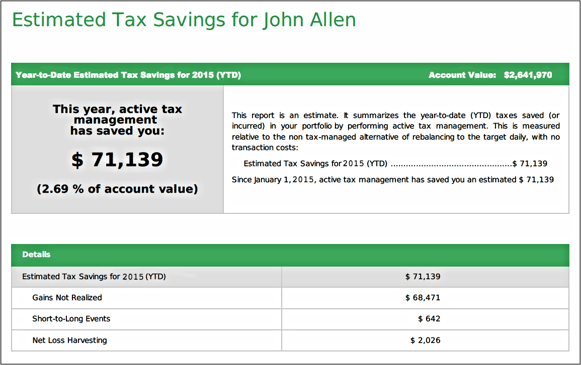

Smartleaf Clients Documented Big Savings with our Taxes Saved Report

Smartleaf generates a "Taxes Saved" for every account to document the amount investors have saved through active tax management.

Over the last two years, the Taxes Saved report has illustrated the benefits of managing taxable portfolios on Smartleaf:

- Observed tax savings are large - greater, on average, than most advisors' fees.

- In 2014, the average equity portfolio tax-managed on the Smartleaf system saved 1.97%.

- As of December 1, 2015, the average year-to-date savings for tax-managed equity portfolios was 1.86%.

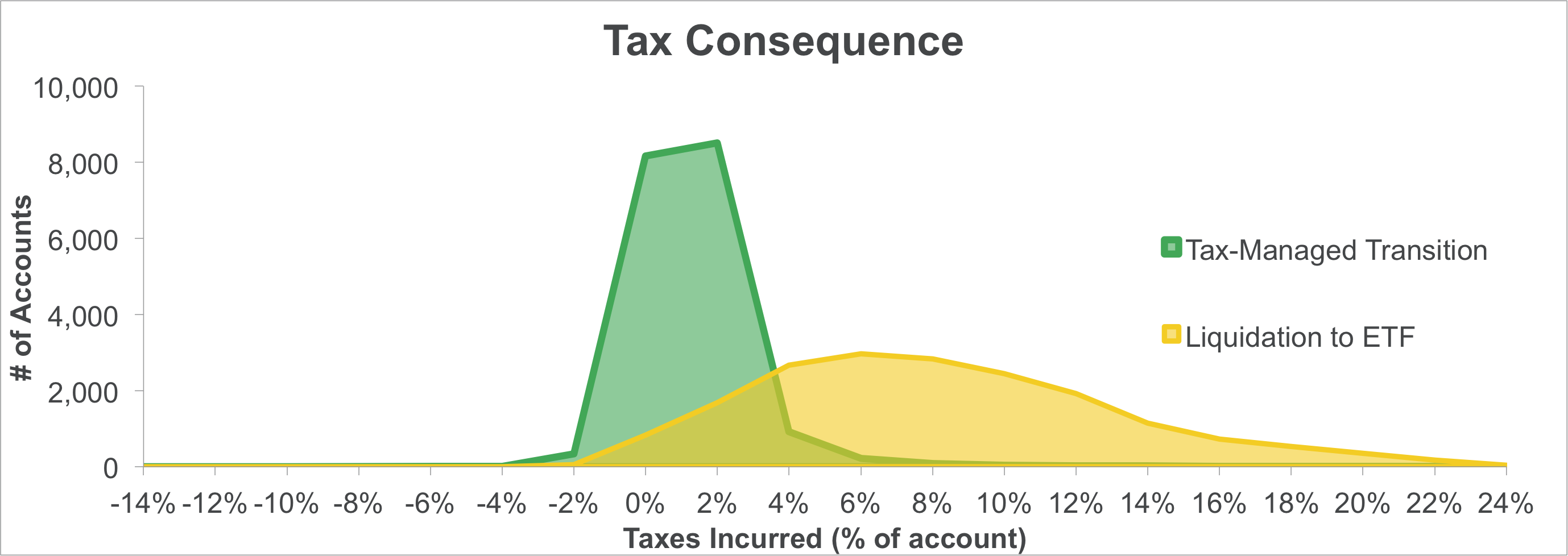

We Showed How Tax-Sensitive Transition Saves 6.92% of Portfolio Value

In a study of more than 18,000 large-cap equity accounts, we compared 2 trading scenarios:

- Liquidation and purchase into an ETF portfolio

- Tax-sensitive transition to a passive equity model using the Smartleaf system

The graph below shows the distribution of tax consequences, as a percentage of starting portfolio value, for liquidation (shown in yellow) and tax sensitive transition (shown in green).

Our results show that Smartleaf's tax sensitive transition analytics generated an average savings of 6.92%of portfolio value.

Our Six-Year Automation Backtest Showed a 1.97% Boost to After-Tax Returns

We set out to test the power of Smartleaf's automated analytics. In a backtest study, we ran our system on full autopilot for six years, from 2008 to 2013. Portfolios were analyzed daily, trading when pre-set cost/benefit thresholds were exceeded (6.84 times per year, on average).

The system generated more than 1.97% in after-tax returns:

|

Pre-Tax Returns: |

-0.44% | |

|

After-Tax Returns: |

1.97% | |

|

Annual Tax Alpha: |

2.41% | |

|

Average Tracking Error: |

1.99% |

COMMENTS