What if you could demonstrably save your clients more in taxes than you charge in fees?

What if you could document to clients and prospects that you save them more in taxes than you charge in fees?

Altium Wealth Management is a $2.8B RIA that has organically grown its AUM by more than 30% per year for over 10 years. Their primary mission is to serve as their clients’ financial consultant, starting with in-depth financial planning, including estate planning and cash flow and distribution modeling. Second, they provide their clients with cash and asset management. Tax management is, at best, third in their list of value added services.

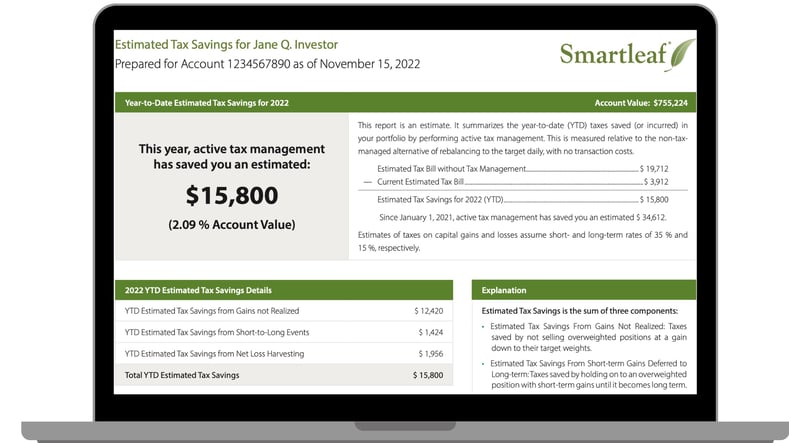

Nevertheless, Altium takes tax management seriously, leveraging Smartleaf’s software to provide their clients with an industry-leading level of tax optimization. They use Smartleaf’s Estimated Taxes Saved Report to provide each client with documentation of how much the client has saved in taxes through Altium’s active tax management.

Altium reports that their ability to document the value of their tax management is often pivotal in client decisions to entrust Altium with managing their assets. What sets tax management apart is not that it is the most important value delivered but that its benefits are quantitative and measurable. It’s an easily understood and substantive indicator of excellence, one that clients and prospects can use to judge the expected quality of the less easily measured aspects of their service. And since not all firms have the capability to both manage accounts in a tax-optimized manner AND document the value added, it’s also a tangible differentiator.

With some clients, Altium is able to show that they saved the client more in taxes than the client has paid in fees, inclusive of pass-through fees for third-party models. This is obviously a nice outcome.

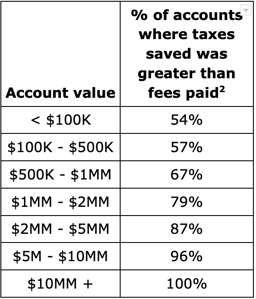

And it raises a question: how often does this happen? What percentage of accounts had tax savings greater than their fees? Smartleaf conducted a study that looked at this question.

The answer: 68%.

68% of their accounts saved more in taxes than paid in fees, inclusive of pass-through fees for third-party models. And that number rises to 90% on a dollar-weighted basis.1

A deeper look at the numbers

We wanted to understand what distinguished accounts with especially high tax savings, measured as a percentage of account value, so we took a closer look.

Not surprisingly, we found that larger accounts did better than smaller accounts. This is because larger accounts tend to:

1. hold more individual equities, which are generally more tax efficient than ETFs and mutual funds.2. be taxed at higher rates (so tax management has greater benefit).

3. pay lower management fees (as a percentage of account size).

Here are the numbers:

Of note, 100% of accounts over $10MM saved more in taxes than were charged in fees.

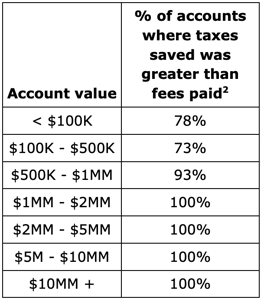

We also found that accounts did better the larger the allocation to equities and the smaller the allocation to fixed income. This is because there is more room to actively tax manage equites than fixed income instruments, especially individual fixed income securities (we’re not here counting the use of municipal bonds and other tax-advantaged instruments as “active tax management”).3

To see this, below are the numbers for those accounts that were 100% equites (no fixed income at all), broken down, as above, by account size:

Of note, 100% of all-equity accounts over $1MM saved more in taxes than paid in fees.

Are these results typical? Are they replicable?

Few firms manage taxes at Altium’s level. And even fewer are able to document the value of their tax management. So these results are not typical.

But they are replicable. Altium does two things that sets their tax management apart. One, they make broad use of direct indexing for equity positions. Two, they use advanced rebalancing technology (ahem, ours), which enables them to provide best-in-class tax management and then document it. Altium does these things well, but there’s nothing preventing other firms from doing them, too. It’s a choice. Most firms have simply not made tax management a priority.

We’re pretty confident that the type of tax management that Altium provides — with the concurrent ability to tell most clients that they save more in taxes than they pay in fees — will eventually become industry standard. In the meantime, firms like Altium will retain a competitive advantage.

About Altium

Hightower Altium Holding is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC, member FINRA and SIPC. Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC. This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guarantee that the investment process or the investment opportunities referenced herein will be profitable. Past performance is neither indicative nor a guarantee of future results. The investment opportunities referenced herein may not be suitable for all investors. All data or other information referenced herein is from sources believed to be reliable. Any opinions, news, research, analyses, prices, or other data or information contained in this presentation is provided as general market commentary and does not constitute investment advice. Hightower Altium Holding and Hightower Advisors, LLC or any of its affiliates make no representations or warranties express or implied as to the accuracy or completeness of the information or for statements or errors or omissions, or results obtained from the use of this information. Hightower Altium Holding and Hightower Advisors, LLC assume no liability for any action made or taken in reliance on or relating in any way to this information. The information is provided as of the date referenced in the document. Such data and other information are subject to change without notice. This document was created for informational purposes only; the opinions expressed herein are solely those of the author(s) and do not represent those of Hightower Advisors, LLC, or any of its affiliates.

1 That is, 90% of the dollars managed are in an account where the taxes saved exceed the fees. For example, imagine there are three accounts with the following assets: account 1 has $100; account 2 has $300, and account 3 has $600. Suppose further that accounts 2 and 3 saved more in taxes than were charged in fees. In this example, we’d say ⅔ of the accounts (accounts 2 and 3) saved more in taxes than paid in fees, but 90% of the assets ($900 out $1,000) were in accounts (again, 2 and 3) that saved more in taxes than paid in fees.

2 Client fee data provided by Altium Wealth Management.

3 Fixed income instruments are, in general, less volatile than equity instruments. This means that fixed income instruments, on average, generate fewer opportunities to lower taxes through either active tax loss harvesting or by gains deferral (since there tend to be fewer gains. Individual fixed income instruments are also less liquid, further diminishing the opportunities for loss harvesting. Individual fixed income securities are also, as a matter of course, held until maturity, so there is little opportunity for gains deferral in the technical sense of holding onto overweighted positions solely in order to reduce taxes. As noted earlier the tax savings from purchasing municipal bonds and other tax-advantaged vehicles is not included in the calculator of “Taxes Saved”, in part because it is not really “active” and in part because the majority of those savings are counterbalanced by the lower average yield of municipal bonds.

COMMENTS