What you can accomplish for your clients in a crisis when you have rebalancing automation: a look at the data.

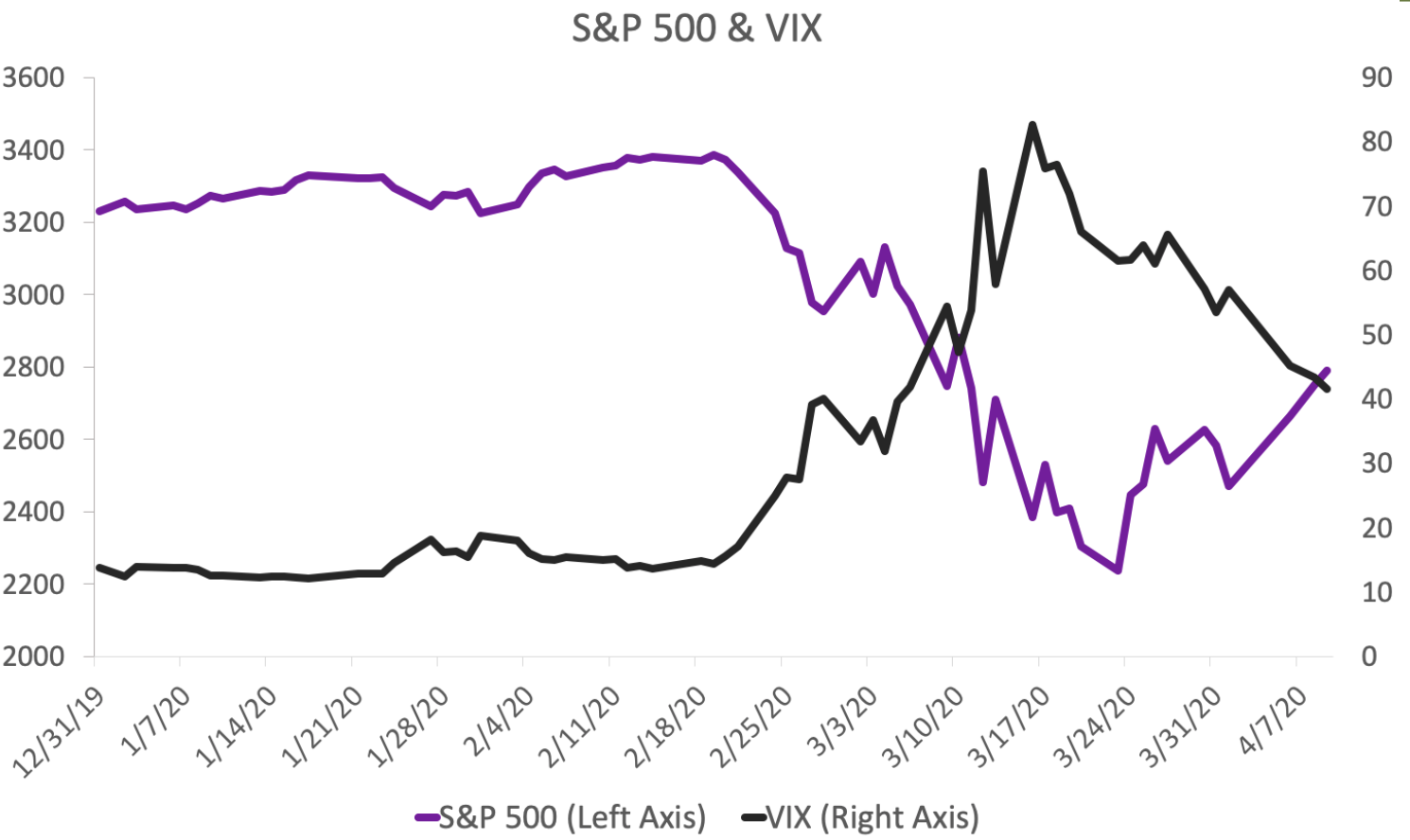

We’d like to share some data on how our clients fared in March by leveraging the power of rebalancing automation. Let’s start with the market environment. Below is a graph of the S&P 500 and the VIX index (a measure of volatility):

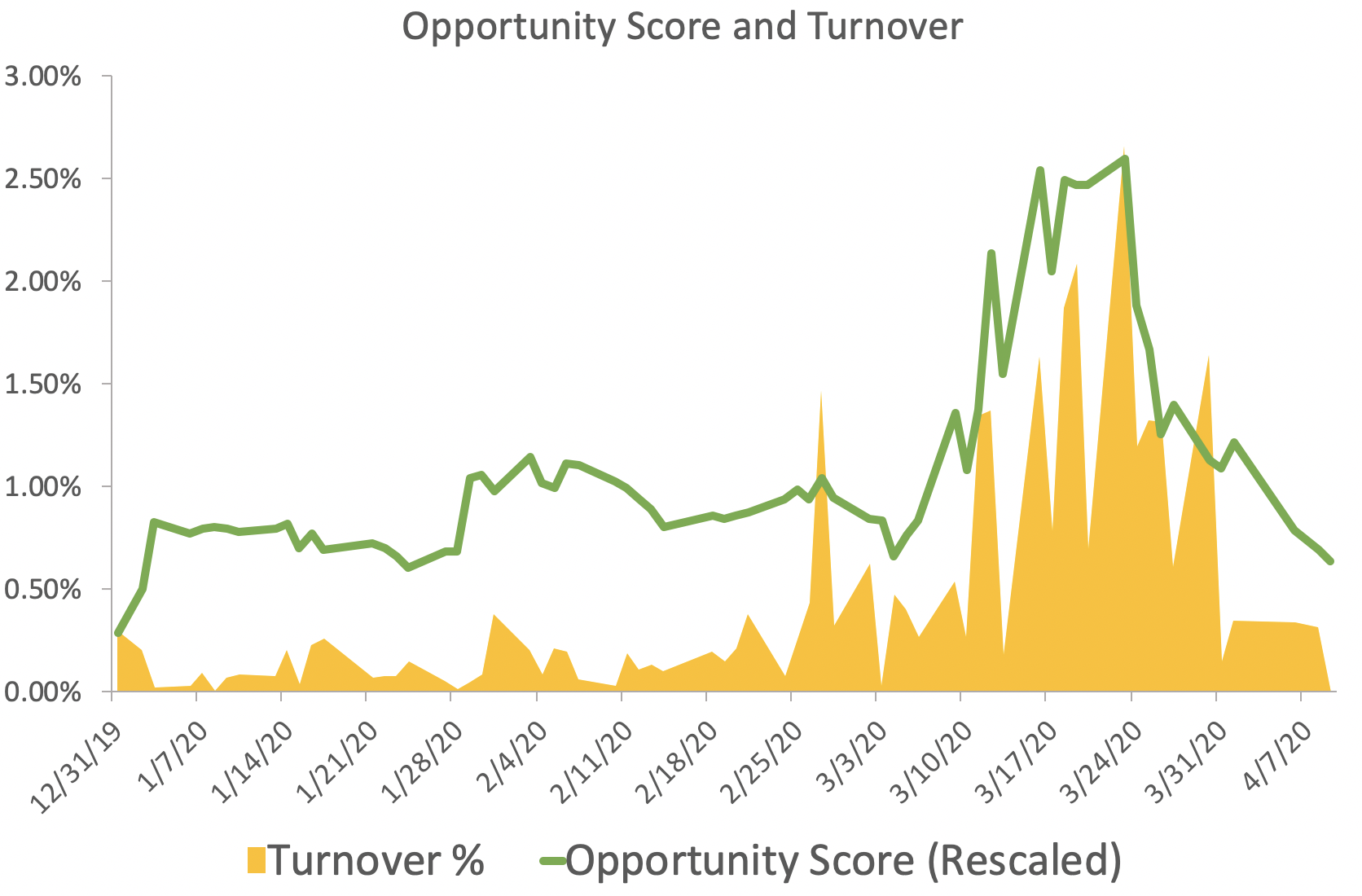

The Smartleaf system generates trades for each account, every day, and assigns the trades for each account a cost/benefit score (we call it an “opportunity score”). Benefits include getting closer to your target asset allocation, getting closer to your target weights for each security, buying more of the securities you rank highly, and realizing losses (loss harvesting). Costs include transaction costs and taxes on capital gains. Below is a graph of the weighted average opportunity score for the wealth management book of one of our clients in Q1. It spiked in early March:

Our clients use the Opportunity Score as a cue for trading, as can be seen in a graph of the daily average turnover of the firm’s book (yellow in the graph below):

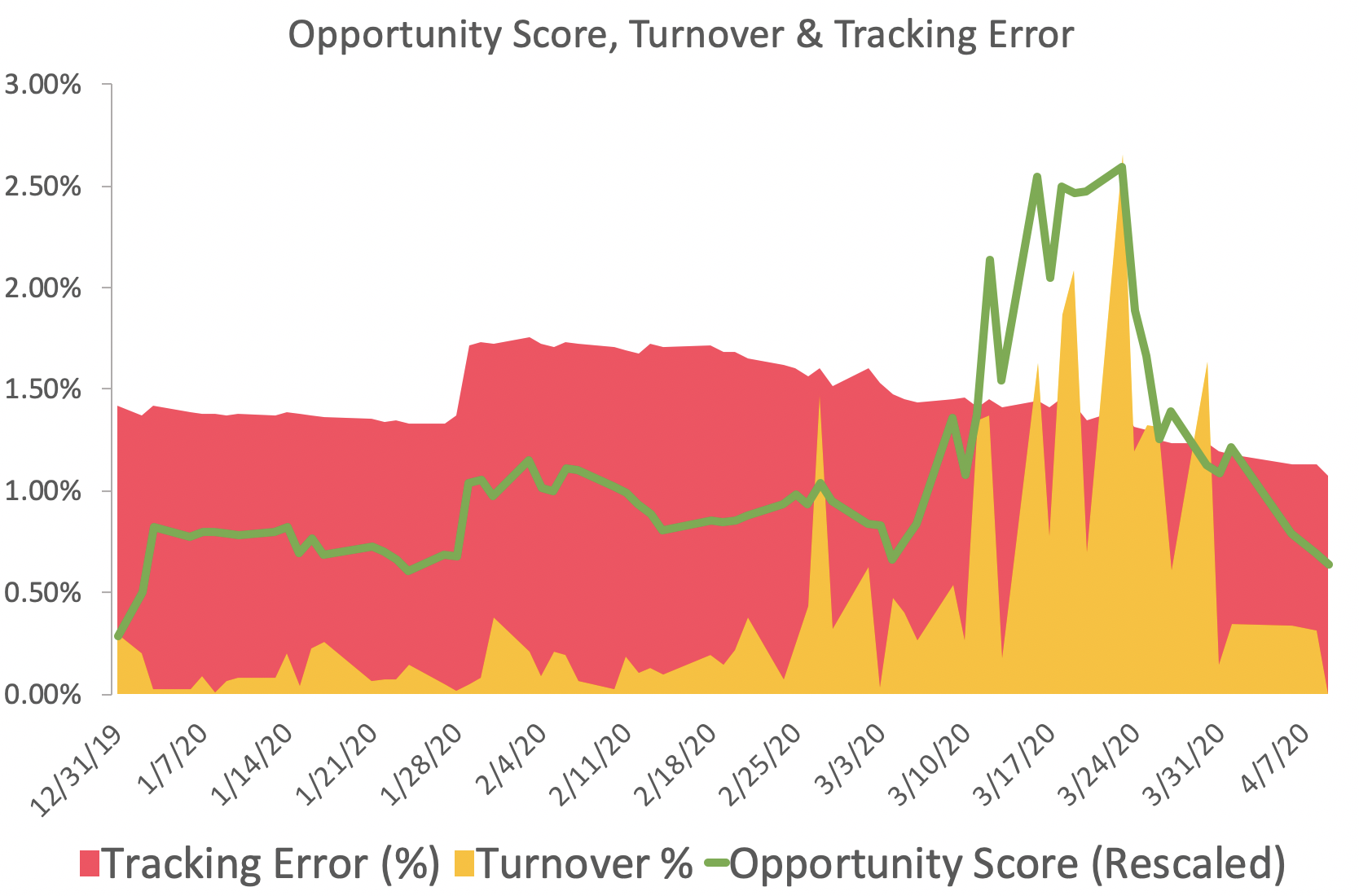

The result of the increased trading?

First, average portfolio drift, as measured by tracking error, was not only contained in the volatile market, it went down (red in the graph below):

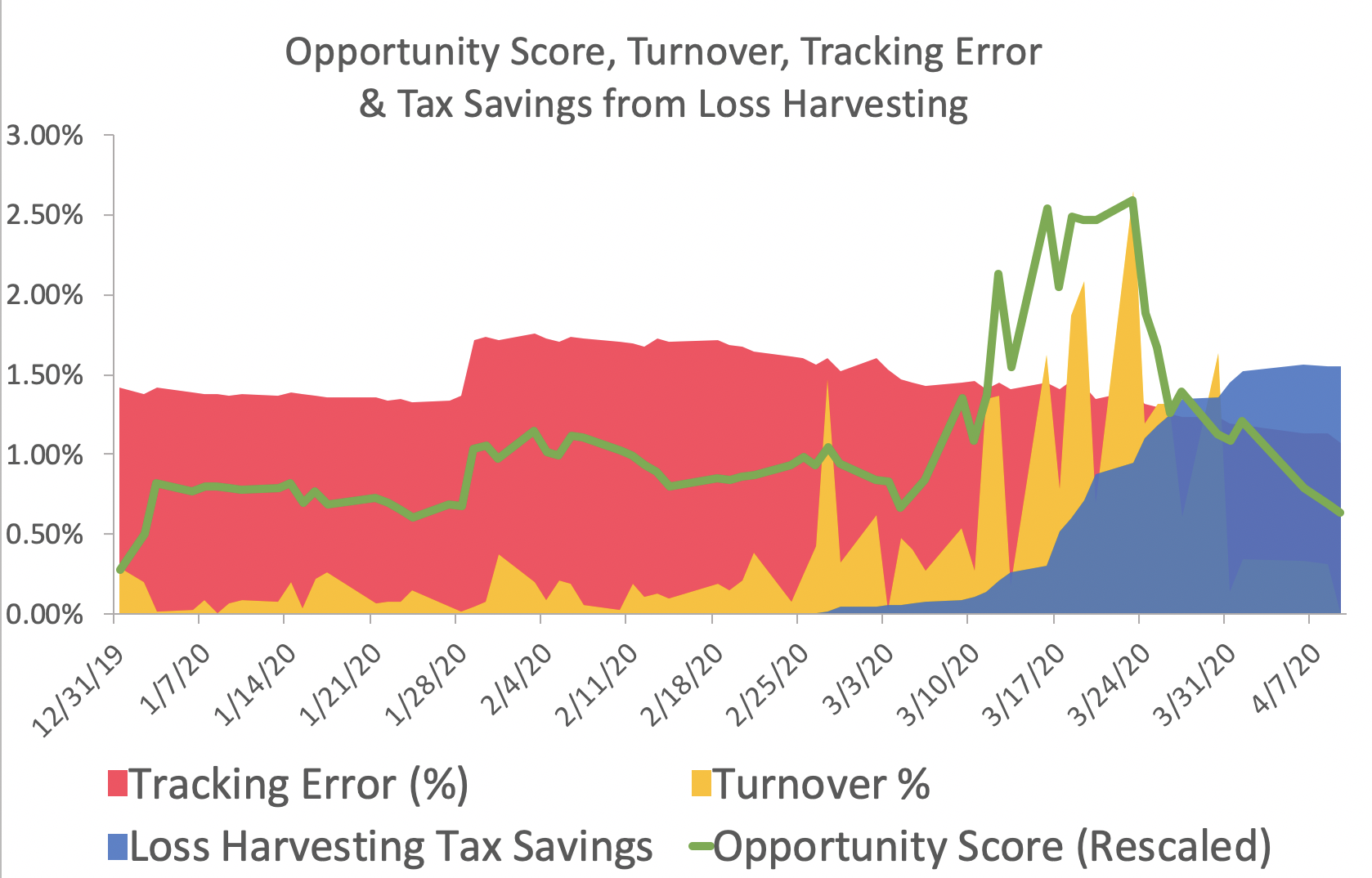

The market decline was an opportunity for our clients to harvest substantial losses. These losses are likely not immediately valuable to investors, but they can be used at future dates. We saw similar behavior in 2008.

The graph below shows that, by actively harvesting losses, our clients generated tax credits that will save their clients an average of 1.5% of portfolio value in taxes. That is, assuming no change in pre-tax returns, our clients boosted their clients after-tax returns by 1.5%, just in March alone.

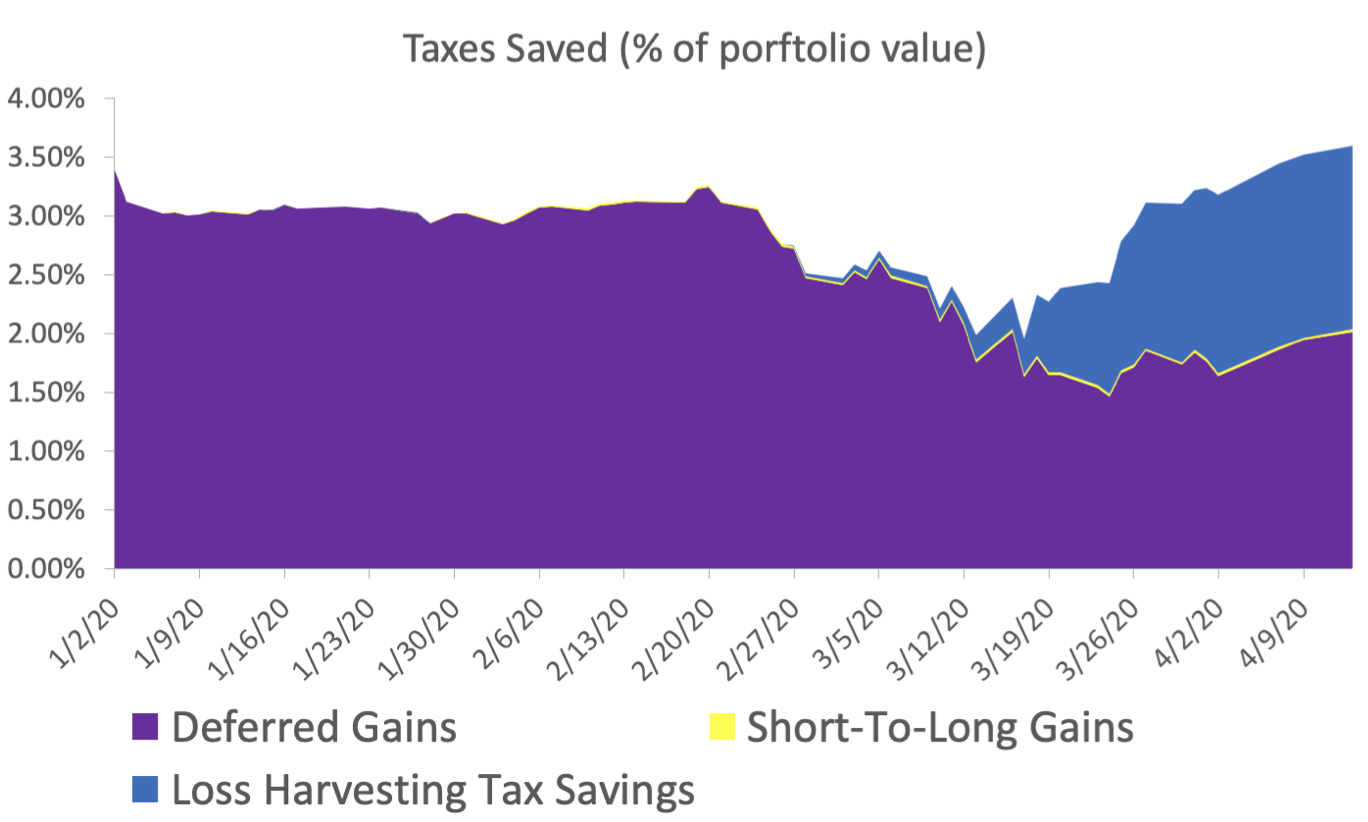

Loss harvesting is one component of active tax management. The other is gains deferral, the risk-balanced incorporation of overweighted assets into a portfolio. The graph below shows the total tax savings our clients have generated for their clients. The savings from unrealized gains went down, as a result of the market decline. But this was more than compensated by the value of loss harvesting:

As these charts show, our clients were actively rebalancing portfolios in March. At the same time, they were active in client outreach. The two are connected. They were able to rebalance their books effectively because they have leveraged rebalancing automation tools to enable a centralized group to handle trading. This frees investor-facing advisors to spend all of their time focused on the investor.

If these charts are interesting, Smartleaf hosted a webinar with Bill Martin, CIO of INTRUST Bank, and Greg Slater, CIO of Altium Wealth, discussing how Altium Wealth and INTRUST Bank leveraged rebalancing automation to control their accounts and add value for their clients in a volatile market. Watch the recording here.

COMMENTS