Transitioning a legacy portfolio can generate large capital gains taxes. Smartleaf’s tax-sensitive rebalancing system, used in conjunction with direct indexes, can significantly reduce—and in some cases eliminate—the tax burden of transition.

Estimated savings of 6.92%

This research brief explains and quantifies these benefits. We analyzed over 18,000 actual portfolios that were managed on Smartleaf’s system in June of 2015 and compared two transition scenarios:

- Liquidate all large cap legacy holdings and buy an S&P 500® ETF

- Use Smartleaf’s system to transition large cap legacy holdings to a seventy-stock direct index SMA model designed to track the S&P 500.

Smartleaf’s system automatically analyzes the tax impact of selling each security in a legacy portfolio against the objective of tracking the S&P 500. This methodology reduces turnover and taxes.

We calculate the average savings to be 6.92% of large cap value.

Direct indexes—portfolios of individual equities that track index benchmarks—have other advantages over ETFs: for example, they can be customized and enjoy ongoing tax advantages relative to an ETF. However, this research brief addresses only the tax advantages of the initial transition.

Procedure:

Smartleaf’s overlay portfolio management system is used to manage $50 Billion in assets by roughly 30 wealth management firms. We selected 18,376 current live accounts that had at least twenty S&P 500 securities and stripped them of all securities that were not in the S&P 500. We created two copies of these accounts, preserving their original lot-level cost bases, and compared the tax, turnover and tracking error impact of two transition scenarios:

- Liquidate all holdings and buy IVV, an S&P 500 tracking ETF

- Transition the holdings to a seventy-stock direct index SMA model designed to track the S&P 500, using Smartleaf’s automated transition rebalancing logic with recommended tax-management settings.

The study assumed tax rates of 43.4% for short-term capital gains and 23.8% for long-term capital gains. Commissions were set to $0.005 per share (the actual brokerage cost in Smartleaf Asset Management’s SMA program) and minimum trade size was set to 10 bps. All analyses utilized market data from end-of-day June 26th, 2015.

Results:

- On average, tax sensitive transitioning to the seventy-stock direct index model saved 6.92% of large-cap portfolio value compared to liquidating the portfolios and buying IVV.

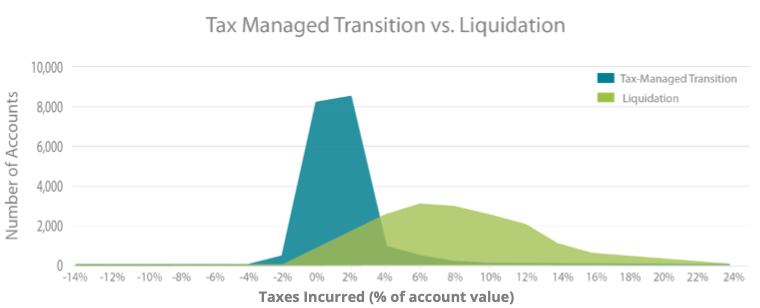

- Liquidating portfolios and purchasing IVV had a mean tax cost of 7.21% with a standard deviation of 4.92%.

- Tax sensitive transition to the direct index model had a mean tax cost of 0.29%, with a standard deviation of 1.58%.

- More than 46% (46.3%) of accounts transitioning to the direct index model had a net tax less than 5% (4.8%) of accounts transitioning to IVV achieved a net tax benefit.

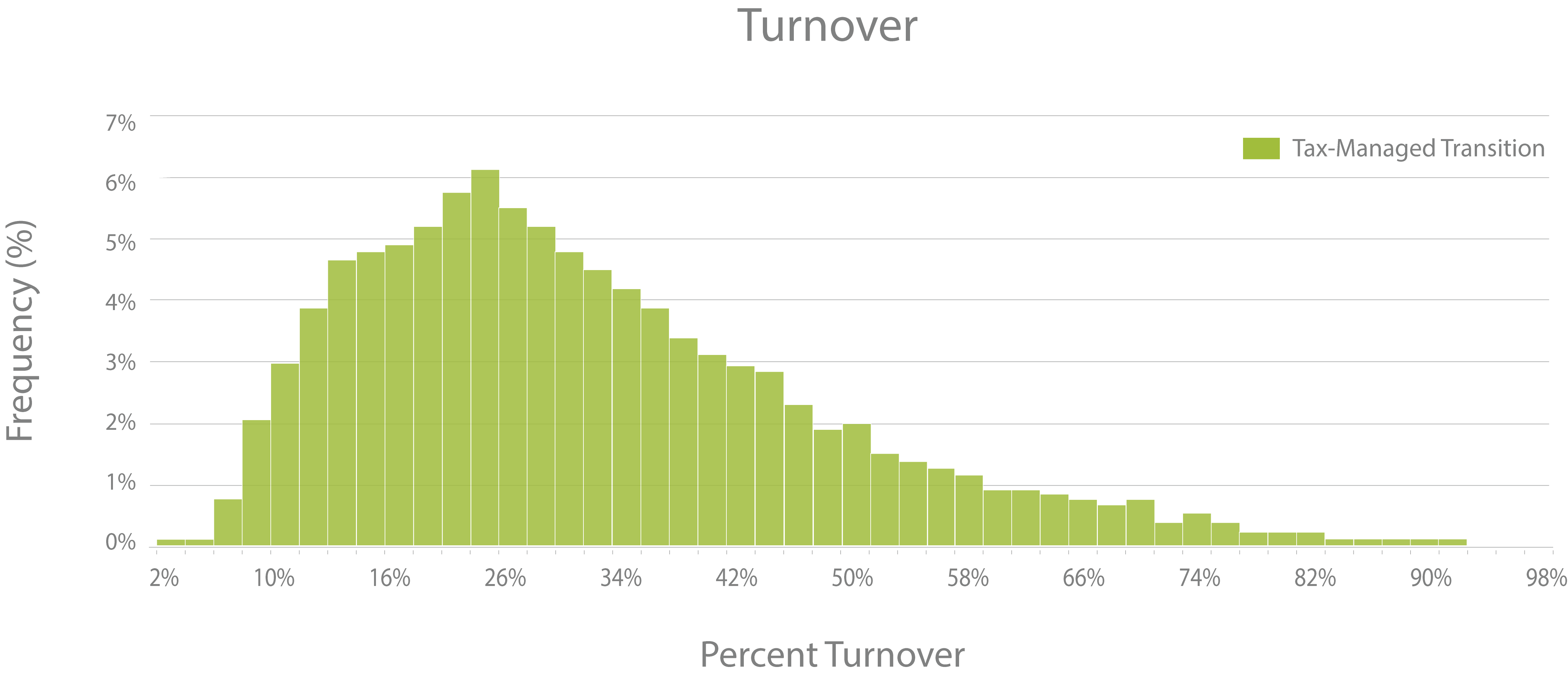

- Accounts transitioned to the direct index model had average turnover of 30.4%. Accounts transitioning to IVV had uniform 100% turnover.

- Almost half of over 18,000 accounts transitioning to the direct index model benefited from tax savings.

- The average tracking error of accounts transitioned to IVV was 0.04%.

- The average tracking error of accounts transitioned to the direct index model was 1.54%.

(Comparative tax impact. Liquidating portfolios and purchasing IVV (red section) has a mean tax cost of 7.21% with a standard deviation of 4.92%.Tax sensitive transition to the direct index model (green section) has mean tax cost of 0.29%, with a standard deviation of 1.58%.)

(Distribution of turnover of portfolios transitioned to Smartleaf’s direct index model. Portfolios transitioned to IVV had a uniform turnover of 100%.)

Interested in seeing if Smartleaf can help your firm implement tax-sensitive transitioning? To set up a complimentary transition study of your accounts, call us at (617) 491-5445, email us at sales@smartleaf.com.

Important Limitations and Disclosures

This study provided by Smartleaf, Inc. for informational purposes only. The tax benefits described in this Research Brief are hypothetical, not actual, and based on back testing of simulated, not actual, transactions. The results were dependent on the components of portfolios transitioned, the components of the target model selected and the market prices at the time, all of which are subject to change. Any changes in these factors could reduce or eliminate the tax benefits. Different commission charges, advisory fees and other relevant expenses could also affect the results, The relative tracking error to a benchmark of an ETF and an SMA will also be affected by these factors. A direct index SMA may not be appropriate for all clients or portfolios.

Smartleaf is not an investment advisor or a fiduciary, and expresses no opinion about the advisability of investing in any security, investment product or strategy. Nothing in this Research Brief is intended to constitute investment advice or a recommendation to make any kind of investment decision and may not be relied on as such.

This Research Brief illustrates the potential tax benefits of using Smartleaf’s system under certain conditions. The target SMA model used in this study was developed by Smartleaf’s subsidiary, Smartleaf Asset Management LLC (“SAM”). This Research Brief does not present any actual or hypothetical investment performance of any account advised or managed by SAM nor does it present any model investment performance. SAM makes no representation, warranty, assurance or guaranty that any index linked models or investments will accurately track index performance. provide positive investment returns or provide tax benefits. SAM is registered as investment advisor with the Securities and Exchange Commission (SEC). (Such registration does not imply a certain level of skill or training).

COMMENTS