Smartleaf unveiled its upcoming automated household rebalancing functionality at the Smartleaf Summit user conference

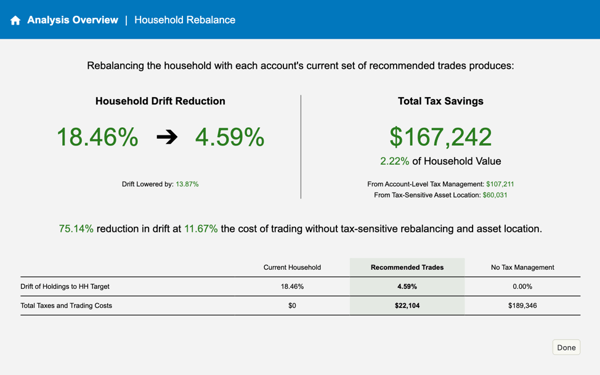

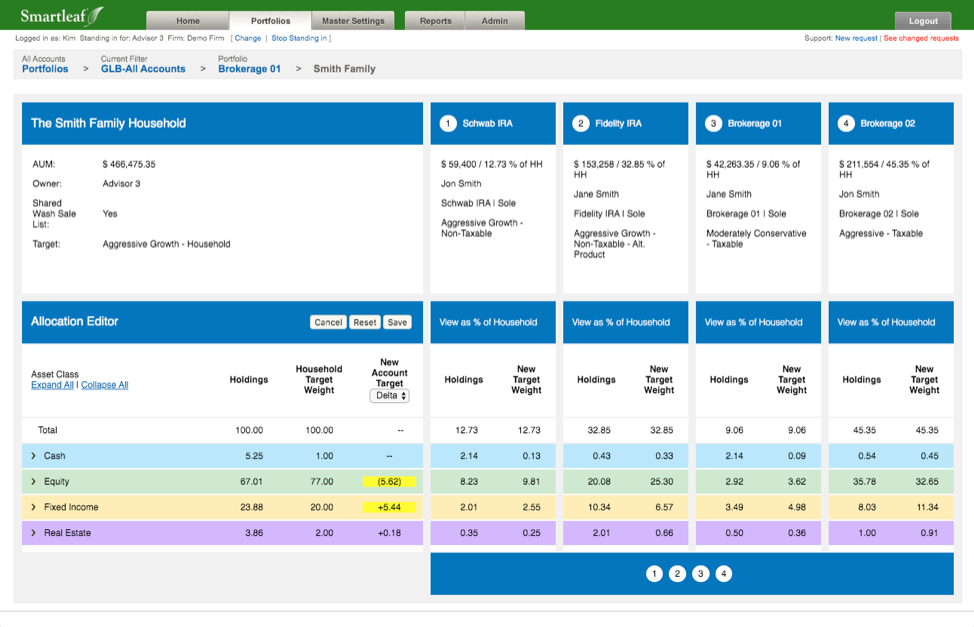

Smartleaf demonstrated their new automated household-level rebalancing feature at the Smartleaf Summit earlier this month. This functionality allows wealth advisors to jointly manage multiple accounts to a single target, leveraging tax-advantaged accounts to reduce overall drift and taxes — and do so at scale. By automating this capability, firms will be able to streamline a currently manual process, saving time and providing clients with enhanced risk and tax management services. Smartleaf’s household-level rebalancing functionality will also provide advisors with auto-generated reports that quantifiably document the value the advisor provides clients through expert household-level tax management.

Conference attendees received hands-on training of the new feature, which will be released in phases beginning in Q4 of this year.

Bill Martin, CIO at INTRUST Bank, commented, “Smartleaf’s household rebalancing sets a new bar for the level of service that advisors should provide their clients. This enhanced tax and rebalancing functionality is a win for both us and our clients. By automating services that we previously provided manually, our advisory team will be able to provide our clients with more value. It’s a great example of how technology is helping to bring wealth management to a new level.”

“Smartleaf’s mission is to enable wealth managers to provide all clients with a level of service that was once the exclusive preserve of ultra-high-net-worth investors,” said Gerard Michael, President of Smartleaf. “Automating household-level risk- and tax-sensitive rebalancing is a critical step on this journey. We are delighted to announce the release of this unequaled functionality that we think will set a new standard for wealth management.”

About Smartleaf

Smartleaf has reimagined the way portfolios are managed, enabling wealth advisory firms to deliver ultra-high levels of customization and optimized tax management at an unprecedented scale. Their software platform is used to manage everything from custom-tailored $100MM taxable UMA accounts to $5 robo accounts with fractional shares.

To view the original press release, click here.

COMMENTS