We address common objections to loss harvesting

I was recently asked if tax loss harvesting is overrated — does it really add value? The short answer is yes, it does. (On the other hand, there’s more to tax management than tax loss harvesting, so the value of tax management does not rest or fall on the value of tax loss harvesting. More on this later.) There are three common critiques of loss harvesting:

- It’s too complicated.

- It’s good for a couple of years and then dries up.

- It’s just delaying the inevitable.

Let’s take a look at these loss harvesting objections one at a time.

Objection 1: It’s too complicated.

A recent article in The WSJ highlighted the complexity of loss harvesting, including an egregious example of TD Ameritrade not being able to hold a suitable substitute during the wash sale period. Loss harvesting is complicated, but only in the sense that updating spreadsheets is complicated — hard to do by hand, easy to do with computers. Sophisticated loss harvesting that avoids mistakes like TD’s can be completely automated — no fuss, no muss.

Objection 2: It’s good for a couple of years and then dries up.

The concern here is that you eventually run out of loss harvesting opportunities. You eventually get “lock in” — every position at a loss has been harvested and all that is left is positions with low basis. This objection is valid up to a point. If you were to buy a portfolio and leave it alone except for loss harvesting you will typically exhaust all loss harvesting opportunities within a few years.

But very few portfolios take the form of “invest all at once and that’s it.” Stuff happens — there are new investments, rebalancing to correct for drift, tactical asset allocation shifts, new security recommendations. Each of these will result in the purchase of new positions, creating new loss harvesting opportunities. (More importantly, every one of these events creates an opportunity to reduce taxes through gains deferral. It’s not tax loss harvesting, but it’s very valuable).

Objection 3: It doesn’t cut taxes, just delays them.

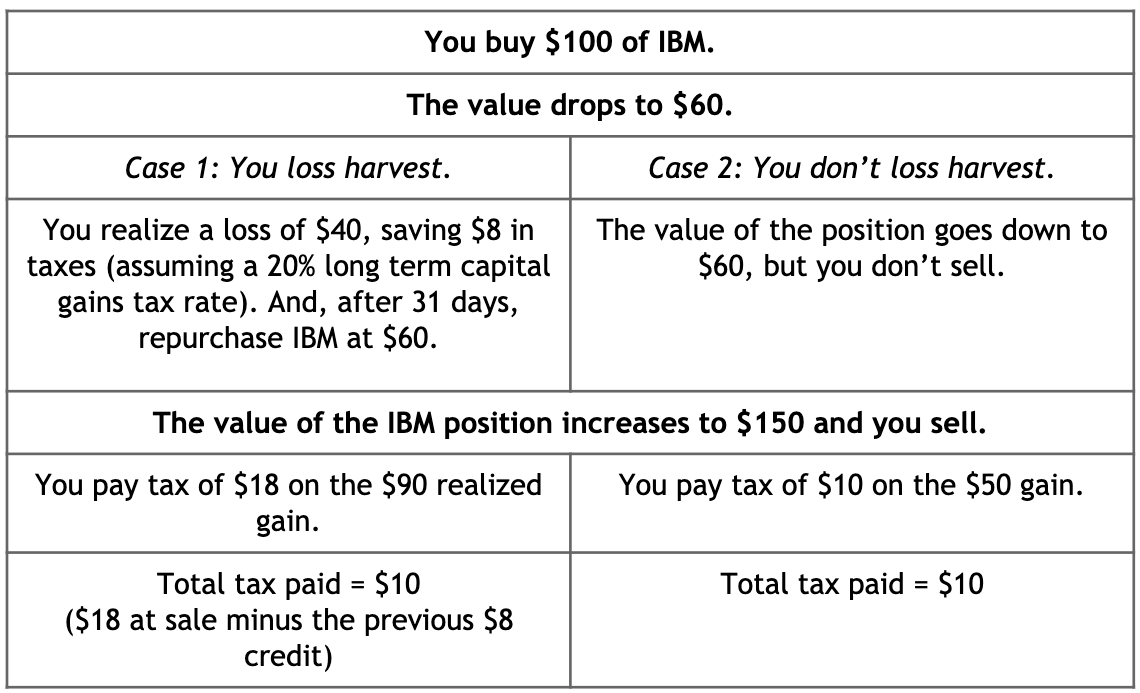

Some forms of loss harvesting don’t eliminate taxes, just delay them. Whenever you realize a loss, you’re effectively “resetting” your basis to a lower number. It’s great that you got a loss, but if and when you eventually liquidate your portfolio, you’ll pay more taxes than you would have if you had never loss harvested in the first place. We can illustrate this with an example:

So it appears that loss harvesting was all for naught, since you ended up paying $10 in taxes in both cases. But even in the case described above, you win because you ended up with an interest-free loan. You save $8 today; you pay $8 later. This is non-trivial. At a discount rate of 5%, delaying tax payment for 10 years means you’re effectively reducing your taxes by 40%. This type of tax management is called tax deferral. As the preceding “effective 40% cut” example shows, it can be quite valuable — and the longer you can defer the tax payments, the more valuable it is.

But tax deferral is just the beginning. Often, you can do better — you can defer but also cut the amount you actually pay. This can happen in three ways:

- You realize short-term losses but long-term gains. If you can realize a short-term loss to offset short-term gains but sell only when the position is long term, you save yourself the difference between short- and long-term tax rates (roughly ½). This is a double win — you’re both cutting the total tax bill AND deferring it (which gives you the interest-free loan we talked about earlier).

- You realize the loss when you’re in a high tax bracket, but realize the gain when you’re in a lower tax bracket. Many investors don’t start drawing down their investments until retirement, when they’re in a lower tax bracket. So, as with the “realize short-term losses but long-term gains” example above, not only do they get an interest-free loan, the gains they realize are taxed at a lower rate. Again, it’s a double win.

- You realize a loss, then hold appreciated shares until death, or donate the appreciated shares to charity. If you hold an appreciated position until death, or if you donate an appreciated position to charity, you avoid capital gains taxes entirely. So you get the benefits of the loss, with no offsetting increase in taxes at a later date. This is a complete win (well, except for the dying part).

Bottom line, the critics are wrong. Loss harvesting is valuable. However, in one sense, the critics are right. Loss harvesting is not the most valuable aspect of tax management. That title belongs to gains deferral — deferring realizing short-term gains until they’re long term and simply deferring gains. Unlike loss harvesting, where opportunities can become scarcer over time, gains deferral opportunities increase over time. The more a portfolio has embedded gains, the more important it is to be careful about what you sell. Gains deferral is important when you rebalance to correct for drift, it’s important when you implement tactical asset allocations. And it’s important when you withdraw funds from your account.

We can put numbers on this. We generate a “Taxes Saved Report” for every account managed on our system, which includes taxes saved from both loss harvesting and gains deferral. It’s not a contest. For most portfolios, gains deferral is the more important source of tax savings — by more than 3 to 1 over the long term. Folks sometimes treat “tax management” and “loss harvesting” as synonyms. They’re not. Loss harvesting is an important component of tax management. But gains deferral is even more important.

So, a cheer for loss harvesting (and three cheers for gains deferral).

COMMENTS