Year-round tax loss harvesting is up to twice as effective as year-end loss harvesting.

We’re approaching the end of the year. Time to look for tax-loss harvesting opportunities in your clients' accounts. Yes?

No. If you’re just getting around to it now, you’re doing it wrong. You’re underserving your clients. And you’re almost surely spending too much time doing it.

If you only loss harvest at year end, you miss the opportunity to loss harvest mid-year dips. This matters. A lot. We estimate that year-round loss harvesting is, on average, 50% - 100% more effective than year-end loss harvesting (it’s about 50% more effective in down and flat markets and twice as effective in up markets).1

To get a sense of why year-round loss harvesting is so much better, look at the following graph of the S&P 500 in 2022 through November 30th. As you can see, there was a small dip in March and big dips in June and October. If you are only getting around to loss harvesting now, it’s too late: you missed two, possibly three previous loss harvesting opportunities.2

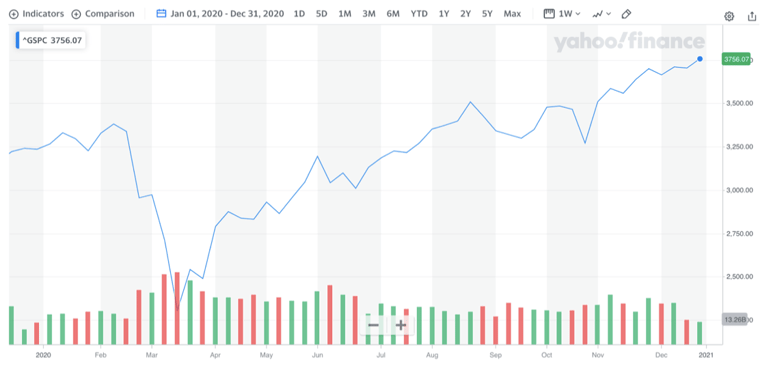

2020 was a particularly glaring example. Below is a graph of the S&P 500 during 2020. As you can see, if you missed the March dip, you lost out completely. That’s a big miss. One client who actively loss harvested in March 2020 was able to generate realized losses that, if used to offset future gain, lowered their clients tax bill by an average of 3.5% of portfolio value.

The only reason year-round tax loss harvesting isn’t more common is that for many firms, loss harvesting is still a largely manual process. For most clients, they simply don’t have the ability to do anything else other than loss harvest at year end.

It doesn’t have to be this way. Loss harvesting can be almost entirely automated. There are simply no practical barriers to providing every taxable client with expert year-round tax loss harvesting. And it’s not just tax loss harvesting. All forms of tax management, including tax-sensitive transition and gains deferral, can be automated. So can customization, like ESG constraints, religious value constraints, custom asset allocations, customer product choice, glide paths and custom cash management.

We recently published a case study of a firm that practices year-round loss harvesting. We looked at the percentage of accounts where they saved their clients more in taxes through active tax management – of which tax loss harvesting is an important component – than the firm charged in fees. The result: 68% of accounts saved more in taxes than paid in fees. This number rises to 90% on a dollar-weighted basis.

If you are just starting to loss harvest, you have our sympathies. It’s too late for you to do anything differently this year, but it's not too late to do better in 2023. Call us if you'd like to learn how.

1. Year-round loss harvesting is more valuable in up markets than flat or down markets because catching “dips” is more important, since there are fewer stocks that simply go down.

To generate estimates of the relative value of year-round vs year-end loss harvesting, we modeled security movement as a lognormal random walk, with a set expected return and standard deviation.

- We performed multiple tests with six different sets of assumptions of security returns and standard deviation:

- Generic large-cap equity security. A mean annual return of a -6.3%, -0.8%, + 9.6% representing, respectively, a down, flat and up market, with corresponding annual volatility of 23%, 27%, and 29% (these figures correspond to individual large cap securities in the 2018, 2015, and 2016 markets.)

- Generic large-cap equity ETF. The same mean annual returns (-6.3%, -0.8%, + 9.6%), but with annual volatility of 17%, 16%, and 13% (these figures correspond to a broad large-cap ETF in the 2018, 2015, and 2016 markets).

- For the generic security, we loss harvested at 85% of cost basis. For generic ETF, we loss harvested at 90% of cost basis.

- In every case, we compared a year-round to a year-end strategy.

- For the purposes of these tests, we ignored wash sales.

- The specific ratio of loss harvesting for year-round vs year-end loss harvesting was:

- For the generic large-cap equity security: 1.6, 1.6, 2.0 for down, flat and up market, respectively.

- For the generic large-cap equity ETF: 1.3, 1.6, 2.0 for down, flat and up market, respectively.

Note that above assumptions are a substantial simplification of Smartleaf’s actual tax loss harvesting algorithm, which considers each investor's tax rates, the volatility of the individual security, time-to-long (for short term positions), time-to-year-end, and the quality of available substitutes. It also prevents wash sales.

For comparison, we also ran tests of “continuous loss harvesting”, where all losses are harvested (i.e. we assume zero transaction costs and zero bid/ask spread). This test maximizes the value of year-round vs year-end loss harvesting. In this edge case, the value year-round was 1.6X, 2X and 2.8X in down, flat and up years for a generic large-cap equity security, and 1.7X, 1.8X and 2.2X for a generic equity ETF.

2. Of course, some individual stocks within the S&P 500 were loss harvestable at year end, but in almost all cases, they were more loss harvestable mid-year.

COMMENTS